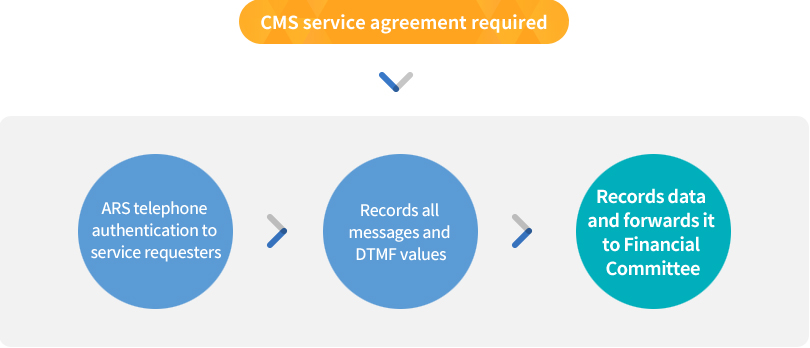

What is the Automatic Transfer Payment (CMS) Consent Record Recording Service?

Automatic Transfer Payment (CMS) is a service that uses automatic withdrawals from the account the payer has agreed to pay for service charges incurred on a regular basis. Recently, there has been an accident that caused a big wave of societies due to an unauthorized withdrawal from the CMS account without the consent of the payer. Therefore, when using the automatic payment service, the consent of the payer is required and the evidence of consent must be kept.

Service advantages / disadvantages

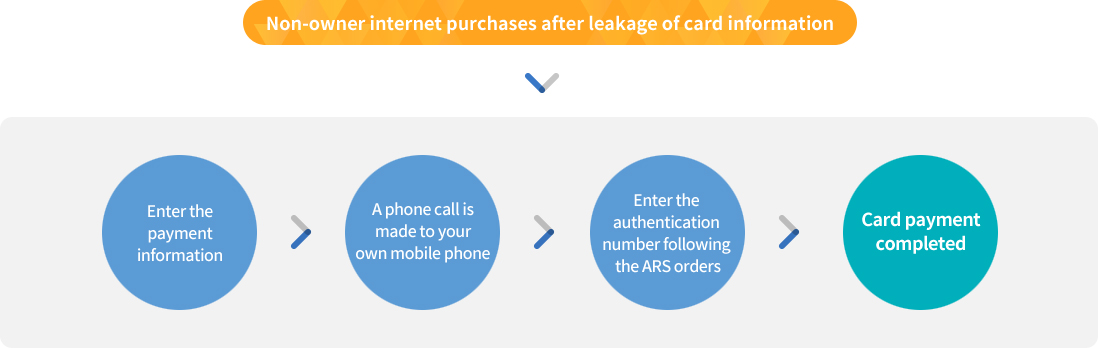

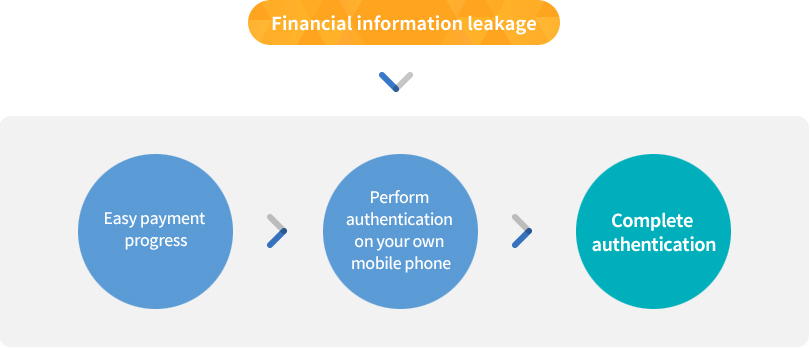

- Prevention of unlawful withdrawal accidents

- Prevents unfair withdrawal accidents using CMS unfair withdrawal and firm banking. Due to Article 15 (1) of the Electronic Financial Transactions Act and the Article 10 of the Enforcement Decree of the Electronic Financial Transactions Act, the automatic transfer payment institution shall automatically forward the automatic payment agreement data from the payer to the financial institution or electronic financial service provider.

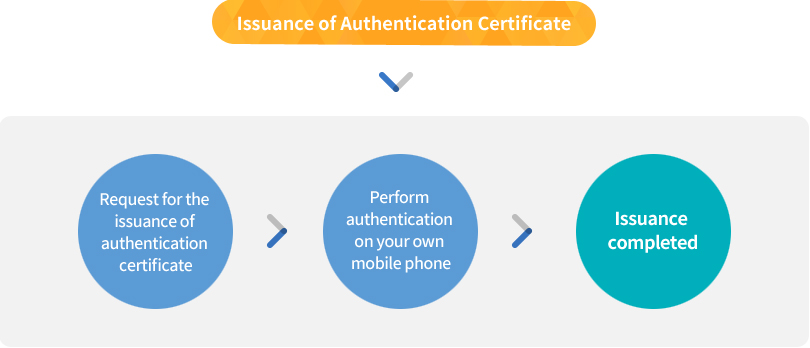

- Confirmation of consent of the payer

- The consent of the payer is obtained by recording, ARS, etc.

We will record your consent and prepare for possible future

legal issues.